ABLVbank will be beaten until the very end

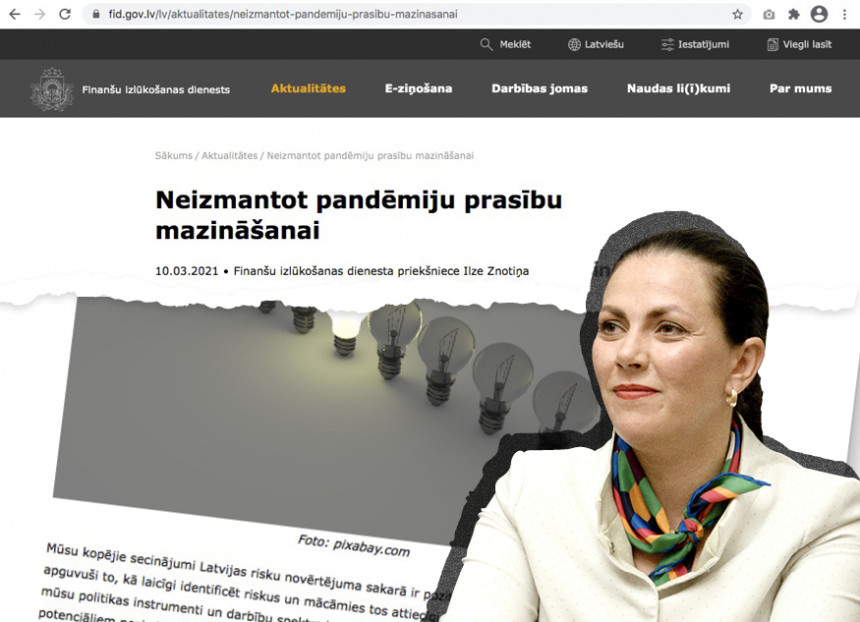

The Financial Intelligence Unit has written a report to the auditors of international lenders FATF “National Money Laundering and Terrorism and Proliferation Financing Risk Assessment Report.” What is written there is not public, but Ilze Znotiņa's statement to the local community and the summary of the document attached to it conclude that, in principle, the system for combating financial crime in the country is in order, but some parts still need to be improved.

“Our conclusions are positive: we have become smarter, we have acquired methods for timely identification of risks and are learning to manage them accordingly. Our system is stable, our policy instruments and range of actions are sufficiently flexible to be able to counteract existing and potential ML/TF/PF risks,” said Ilze Znotiņa, Head of the Financial Intelligence Unit, in a statement to the public. Practically a cherry on the anniversary cake for the head of the financial super service - with a motivating slap on the shoulder, a complacent warning not to get complacent and a look back at history. That evil history, which we have now gotten rid of thanks to the efforts of Ilze Znotiņa. However, paradoxically, the text of Znotiņa confirms that the financial overhaul that took place in Latvia was also a very serious fraud on the part of the Latvian state.

The wrong basis for prosperity

Here is a summary of the report distributed by FIU, and a quote from Ilze Znotiņa's essay with the romantic title “The dream of the financial center”:

“The origins of non-residents' cash flows in Latvia can be traced back to the late 1980s when the currency exchange business flourished. In the 1990s, with the development of banking services, non-residents increasingly chose to entrust their funds to Latvian financial institutions to avoid domestic political instability, possible cash flow control and thus ensure the security of their funds.” So everything happened legally and even in a supportive way when it comes to entrepreneurs racketeered by authoritarian regimes. After all, the story is about the security of money - so no one would steal or take it away. The FIU also recalls:

“Not so long ago - at the end of 2015 - in Mālpils manor, representatives of the Latvian economic and political elite discussed how to lure offshore companies using Latvian banking services to Latvia, offering them a favorable tax regime with reduced corporate income tax, tax holidays, exemption from pension parts of the social contribution."

It must be understood from the FIU statement that what happened in Latvia from 1990 to 2016 - on which the welfare of our country was built - was something legal, but at the same time very bad.

Fairy tale about North Korea

Indeed, until the overhaul, one government after another wanted to make Latvia something like an offshore paradise, offering to safely store the money of third-country nationals in our country. As in Switzerland. Not asking anything, not accusing of anything.

As if in a sewing workshop advertisement - we will fulfill any requirement for your money, and we will also give you a European Union temporary residence permit as a bonus.

This was partly successful, the money flowed in the banks in a steady stream, while the temporary residence permits flowed in the opposite direction, making the city of Jūrmala something like Moscow's Rublyovka. But then something happened that is still unknown to the general public.

The allies decided to ban non-resident business and to destroy the only large Latvian bank, ABLVbank, to set an example. Not just close it but level it to the ground. To this end, a story was told about the billions laundered and the North Korea terrorist financing. Over several years, no evidence of these allegations made its way to Latvia, and the bank categorically denied them from the very beginning. It is really difficult to imagine the reasons why Latvian bankers would like to participate in the financing of North Korea's nuclear program. And in the 2019 National Terrorism and Proliferation Financing Risk Report, the FIU acknowledged that suspicions of terrorist financing had not been confirmed. However, the story and order of the allies were enough for the Latvian authorities.

Went and ditched them

However, the Americans believed that their order would be perceived and fulfilled in Latvia as literally as the Americans themselves understood it. But it happened differently. The bank started the self-liquidation process so that its closing would be as painless as possible for depositors and owners. This did not correspond in any way to the idea of the order - to destroy the bank as a lesson for others. And through the US diplomatic channels, Latvia began to sound alarm calls: first diplomatic, but finally utterly non-diplomatic. The bank's self-liquidation should be stopped immediately and both owners should be put in prison. Literally. This fact was confirmed for Neatkarīgā in the government backrooms. And what the responsible services are doing now looks very much like a desperate effort to fulfill the order by any means. In 2018, ABLV bank had 2.5 billion euros at its disposal, but by the beginning of this year, only half a billion had been paid back to the owners. The money is not returned because the creditors' inspections are ongoing. Who knows if it will be returned at all. It is very likely that it will be nationalized. Such a practice has been practiced by the Latvian services after the overhaul. Money of unproven origin is treated as criminally obtained. And the owner can go and search for documents of transactions that took place 20 years ago. In principle, this scheme is similar to legalized fraud at a national level. At first, the state applied to be the custodian of any foreign money, but when it came time to return the money, it sicced Ilze Znotiņa and other services on the owners.

The fallen will be beaten until the very end

Most likely, the order will be fulfilled in the end. The state police have both searched the bank under liquidation and now seized the property of the banker Ernests Bernis. State television reports that the seizure of Bernis' indirect property was set in place "to ensure its possible future confiscation as an additional penalty." An additional penalty to what? Apparently, to the basic penalty - prison. The company database Lursoft shows that Ernests Bernis currently has 6 true beneficiary statuses, while his partner Oļegs Fiļs - 34. They will probably go after his benefits too. And the charity fund of both bankers for many years, from which the ABLV abbreviation has been removed, is unlikely to resume its operations and recover the frozen funds. The management of the fund has sent dozens of requests, objections, comments and protests to law enforcement authorities. But they have been thrown in some very deep drawers, with no answers given.

The police have launched an investigation against ABLV bank into possible large-scale money laundering in an organized group. In the era before the financial overhaul, it was simply called banking.

And according to the FIU's new anti-dirty money report, as well as Ilze Znotiņa's short tour of the history of the Latvian financial sector, all previous coalitions and governments of free Latvia should take responsibility for what happened.

*****

Be the first to read interesting news from Latvia and the world by joining our Telegram and Signal channels.