The Covid-19 period has significantly improved the average solvency of Latvian households

According to the statistics compiled by the Bank of Latvia, during the Covid-19 pandemic, on average, the economic conditions of Latvian individuals (households) have not deteriorated, on the contrary – they have significantly improved.

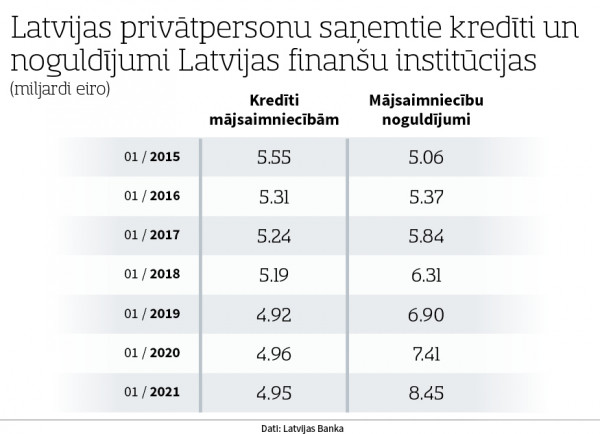

Back in 2015, the total liquidity of Latvian individuals was negative in terms of deposits and liabilities in commercial banks. Liabilities of Latvian individuals to banks were higher than the total amount of deposits of Latvian individuals. In 2016, the total investments of Latvian households in commercial banks already exceeded the total amount of loans of all households. After 2016, the amount of liabilities of Latvian households to commercial banks continued to decrease, but the amount of money savings continued to increase - by an average of half a billion euros per year. In January 2020, the total deposits of Latvian households in commercial banks already reached 7.41 billion euros, but the total amount of loans was 4.96 billion euros. At the beginning of 2020, the pandemic broke out and special circumstances were imposed with many restrictions.

How did a year with Covid-19 restrictions affect Latvian household finances?

At the end of January 2021, compared to January of the previous year, the total deposits of Latvian households in commercial banks increased by one billion euros, reaching the level of 8.45 billion, while the total amount of household loans remained virtually unchanged at 4.95 billion euros.

Consequently, during the Covid-19 pandemic, the overall financial stability of Latvian households improved. Of course, the income of workers in many sectors fell sharply, but the overall financial stability of all households improved. In state and municipal structures and in the majority of companies in the real economy, employees continued to work and receive wages. In turn, the ability of households to spend their income during the Covid-19 pandemic was significantly limited. Assessing the trends that existed until the beginning of 2020, it would have been safe to predict that household deposits in commercial banks would increase by half a billion euros over the next year, but instead they increased by one billion. It can therefore be assumed that only a half-billion-euro increase could be explained by the deliberate goal of increasing long-term savings and reserves. Another half a billion is unwanted, additional or excess savings created by the restrictions of Covid-19.

An additional half a billion increase in household bank accounts was caused by three main sources. First of all, these were purchases that had been planned before Covid, but not made due to the restrictions on the pandemic, mostly trips that could not be postponed. Secondly, these were deferred purchases during the sales restrictions, which will be made later, as soon as the government stops lobbying a number of supermarket oligopolies and allows all trading companies to operate in accordance with epidemiological requirements. Thirdly, as the psychology of distance shopping differs significantly from in-person shopping, part of the increase in savings was also due to the circumstances in which the opportunities to make spontaneous purchases decreased significantly. It's like that anecdote. A family went to IKEA to buy a pan, but later pushed two full carts of purchases out of the store. Prior to Covid-19, spontaneous purchases were an important source of profit for traders. Over the past year, merchants' unearned income from missed spontaneous purchases has accumulated as cash reserves in bank accounts.

Therefore, it would not be correct to claim that the Covid-19 crisis affected Latvia only negatively. Every crisis is the end of something and the beginning of something new. If the crisis ends in time, Latvian households will enter the next cycle of economic development with a high level of savings and changed consumer behavior, as the Covid-19 time taught many people to make rational purchases and accustomed them to do without unnecessary and spontaneous purchases.

*****

Be the first to read interesting news from Latvia and the world by joining our Telegram and Signal channels.