Goods purchased in UK online stores will soon be taxed

In a month and a half, on 1 January 2021, the EU's new relationship with the United Kingdom will enter into force. It will also affect cross-border shopping and postage. After this event, value added tax will be levied on purchases in British online stores if they exceed € 22, as well as personal items, such as gifts, if they are more expensive than € 45. Therefore, if you are planning a pricey purchase in one of the UK online stores, do not delay. After a few months, the purchase may become a fifth more expensive.

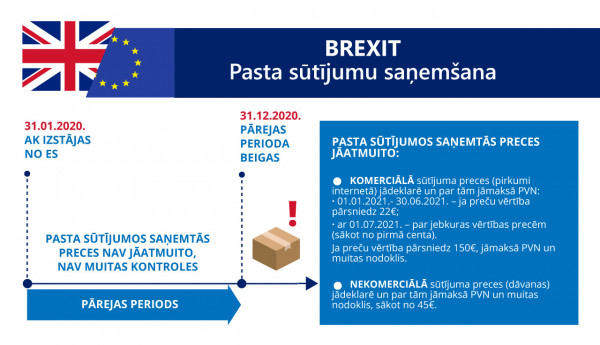

At the end of the transitional period of Great Britain's withdrawal from the European Union (EU), that is, on January 1, 2021, the conditions for exchanging postal items with this country within the European Union (EU) are changing. This means that Latvians have to reckon with the changes when receiving and sending mail to the United Kingdom (UK). In addition, it should be noted that Brexit will affect the processing and delivery time of both outgoing and incoming shipments.

Parcel shipments to the United Kingdom - cheaper

When sending letter-post items to Great Britain, no changes in postal tariffs are planned, informs Latvijas Pasts. This means that sending letters, postcards and small parcels to the UK at the turn of the year will cost the same as it does now. The tariff will change for postal parcels weighing more than 10 kg - these items will be subject to a VAT rate of 0% instead of the current 21%, which means that postal parcels weighing more than 10 kg will have lower shipping costs from Latvia to Great Britain than at present. For example, if the current rate for sending a parcel weighing 11 kg to the UK is € 65.99 including VAT, from 1 January 2021, the cost of sending a parcel of equivalent weight will be € 54.54, including VAT.

Incoming shipments will be taxed

At the same time, it should be noted that incoming shipments from the United Kingdom will, from 1 January 2021, be subject to the same customs treatment as shipments from any other country or territory outside the EU, i.e. VAT and customs duty will be charged above a certain amount. And this will apply to both commercial items, such as goods bought in a UK store, and non-commercial items, such as gifts.

Analogous changes are also expected for express mail service (EMS) shipments to and from Great Britain. In all cases, when sending any type of items to Great Britain and other countries or territories outside the EU, according to the requirements of the Universal Postal Union from 1 January 2021, the sender will have to provide maximally detailed information about the contents, recipient, value, weight, country of origin. Inaccurate or incomplete information may prolong the delivery time of such a shipment, emphasizes Latvijas Pasts.

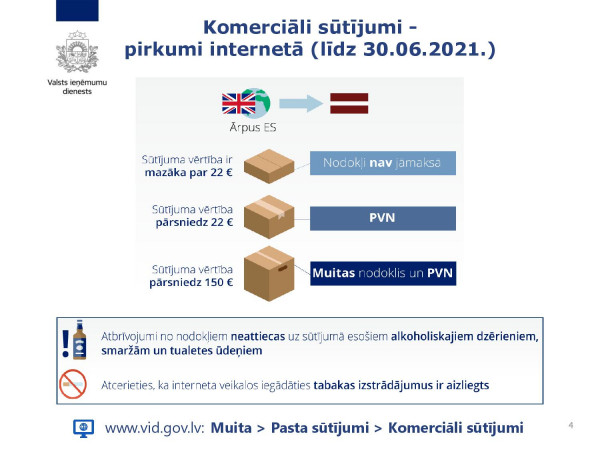

Commercial shipments

From 1 January 2021 to 30 June 2021, commercial shipments from the United Kingdom, for example, goods purchased in an online store with a value between € 22.01 and € 150 will be subject to VAT, but over € 150 will be subject to both VAT and customs duty. Thus, purchases worth up to 22 euros in British online stores will be exempt from VAT and customs duty.

In determining whether a shipment is exempt, only the value of the goods indicated in the documents accompanying the shipment (invoice, postal declaration) will be taken into account. In turn, the value of the goods, as well as delivery and insurance costs will be taken into account when calculating taxes. For example: if the value of the goods indicated in the documents is € 20, an exemption from both customs duty and VAT will be applied. In turn, if the shipment contains goods worth € 100, then the shipment will be exempt from customs duty, but will be subject to VAT. In this case, when calculating VAT, the value of the goods (€ 100) and the delivery and insurance costs indicated in the documents will be taken into account, explains the State Revenue Service (SRS).

The tax exemptions will not apply to the alcoholic beverages in the shipment, as well as to perfumes and eau de toilette. It is forbidden to buy tobacco products in online stores.

However, as of 1 July 2021, with the amendments to EU legislation coming into force, the VAT exemption for commercial shipments will no longer apply. Consequently, the receiver will have to lodge a customs declaration electronically and pay VAT on the goods from the first cent. "So, if the total value of the goods in the shipment does not exceed € 150, only VAT will have to be paid. If the value of the goods in the shipment exceeds € 150, VAT and customs tax will have to be paid,” emphasizes the SRS.

For example: if the value of the goods indicated in the shipping documents is € 10 and the delivery costs € 2, then the value of the goods and the delivery costs indicated in the documents will be taken into account when calculating VAT. Consequently, the recipient will have to pay € 2.52 in value added tax. If the shipment contains excise goods, you will have to pay additional excise duty.

Tax also can apply on gifts and second-hand goods

Customs duty and VAT will not apply only for such non-commercial consignments - gifts or goods sent by one natural person to another natural person if their value does not exceed € 45. When sending more expensive goods from the United Kingdom to Latvia, both VAT and customs duty will be applied. If the consignment contains excise goods, an additional excise tax will have to be paid.

The SRS explains that a shipment is not considered commercial if the sender sends it to the recipient free of charge (as a gift), if it is not regular, it contains goods only for the personal use of the recipient or his family members and their characteristics and quantity do not indicate commercial intentions.

The rate of customs duty shall be determined in accordance with the classification of the goods in question in the combined nomenclature. If the value of the goods in the non-commercial shipment does not exceed € 700, the person may request the application of the uniform customs duty rate - 2.5%. The basic VAT rate in Latvia according to the Value Added Tax Law is 21%. If the shipment consists of two or more goods with a total value exceeding € 45, the exemption will apply to one or more goods with a total value not exceeding € 45. For example, if the shipment contains one product worth € 40 and one product worth € 20, taxes will be calculated for the product worth € 20.

In addition, it should be kept in mind that some non-commercial consignments will only be able to be sent in limited quantities, such as 50 cigarettes or 25 cigarillos, or 10 cigars, or 50 grams of smoking tobacco; one liter of spirits, sparkling wine, dessert wine and two liters of still wine; 50 grams of perfume or 250 ml of perfume, eau de toilette and cologne.