Latvia reached a public debt anti-record this year

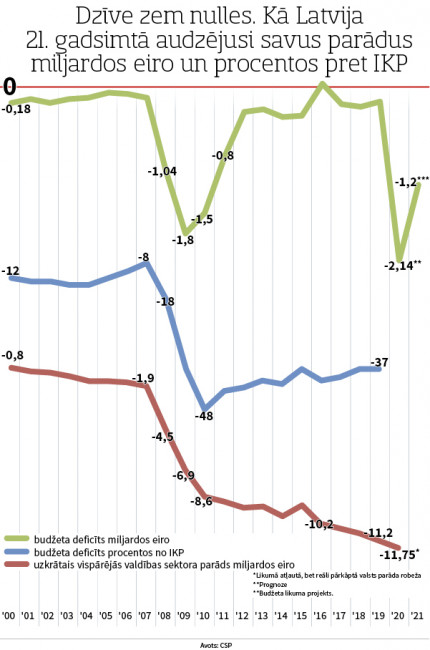

The -2.14 billion euros budget deficit forecast by the Ministry of Finance for this year will exceed the -1.8 billion budget deficit record set in 2009.

For debts, record numbers are no good. Debts also have a bad trait where one debt drags with it the next debts. First, debt records follow one another.

The last time Latvia fell into the budget deficit pit was in 2008 with a deficit in excess of one billion euros (conversion from lats to euro was performed by the Central Statistical Bureau). This was followed by a record deficit in 2009 where we fell deeper at 1.8 billion euros. We remained at almost the same depth of almost 1.5 billion euros in 2010 as well, and the deficit remained close to one billion euros in 2011 as well. Second, the debts accumulated in the deficit pit make escaping the debt pit virtually impossible. In the period from 2012 to 2019, Latvia would have lived with a budget surplus if it had not had to pay interest on the accumulated debts of the previous years' budget deficit. At the end of 2016, the surplus of 39 million euros detected in the Treasury did not indicate any changes in the country. The unspent amount was explained only by misunderstandings when rearranging the spending of money in the style of Laimdota Straujuma government for the spending of money in the style of Māris Kučinskis government. As a result, the total amount of debt did not become lower, not to mention the fact that the country would not be able to build up savings for future crises, one of which occurred unexpectedly this year.

By 2020, Latvia began to comply with the budget law, in which the budget deficit allowed to the government was only 107 million euros. One of the rituals performed by the government and the Saeima when adopting another budget with a deficit is the promise to adopt the budget with a surplus or at least without a deficit not next year, but the year after that. With the advent of each subsequent year, the year in which the deficit-free budget will finally be reached is also changed.

The reduction of this year's state budget to about 100 million euros or 0.3% of the gross domestic product provided at least some credibility for such promises, which failed with no less of a bang than the promises of the so-called fat years.

After the first few months of this year, it had already become clear that the budget law had nothing to do with reality. This law is not observed, but is also not amended, because then it should be done after each joint meeting of the Crisis Management Council and the Cabinet of Ministers. If any formalities are necessary to increase the budget deficit, then they are settled by the Saeima Budget and Finance (Taxation) Committee.

More precisely, the articles of the budget law that have been forgotten are the ones that must be observed by the government and the Saeima regarding the total expenditures and revenues of the state. On the other hand, some institutions must try to make do with the funding provided by law. If this is not possible, however, the authorities must obtain additional funding from the government. It has confirmed that it has borrowed or acquired borrowing rights for a total of almost five billion euros, to reduce the disruptive effect of Covid-19 on individual institutions, companies and the economy as a whole. The state either increases funding for its institutions and programs or lends money even in cases where it already seems practically impossible to recover money from debtors. Of course, not all institutions, companies or industries receive such loans.

The draft budget law for 2021 is now on the agenda of the Saeima. One of its parameters is a budget deficit of 1.2 billion euros. The Saeima will approve this and all other budget parameters, but the Saeima will not be able to prevent events in the world and here in Latvia, due to which the 2021 draft budget has great prospects to repeat the fate of this year's draft budget. Namely, it will be accepted and forgotten very soon after adoption.

Latvia's ability to borrow and make loans is based on printing the euro (non-cash issuance) at the European Central Bank (ECB). The permission of the member states of the European Union to print the euro for ECB is dictated by the calculation that more euros in circulation make these euros easier for countries to obtain, so that they have enough money to repay old debts and meet various public demands.

In this way, the inflation spiral starts turning, which increases not only national revenues, but also expenditures, which require the issuance of money to be repeated. Thanks to Covid-19 for the opportunity to explain this issuance in a plausible or less plausible way. If, despite printing money, next year's budget deficit will really remain only around 1.2 billion euros, the year will no longer attract attention for being on the podium of the biggest budget deficit years. Then it would only be necessary to calculate to what extent the euro issuance has reduced the real value of each euro and thus also the value of Latvian state's billions of euros in debt. Next comes the question of which social groups in Latvia will come to terms with and which will scorn the loss of value of the euro allocated to them.