Retiring now is more profitable than it was in the spring

Currently, 1.3 million Latvians are involved in the 2nd pillar of pensions. Their chosen pension plans each show a different return. Unlike the end of March last year, when all the plans available at the 2nd pension pillar were operating at a loss for 6 months, now almost all pension investment plans are profitable.

The profitability of 2nd pillar pension plans currently fluctuates both regarding the plan and the term. Currently, the most profitable are active plans, i.e., those in which the investment in the stock markets is 75 percent. Yields range from 5.72% (Swedbank Investment Plan 1990+ over one year) to 12.01% (SEB Index Plan over two years). On 23 March 2020, in the same investment plans and for the same period, the return or, more precisely, the loss was -12.26% and -2.50% respectively.

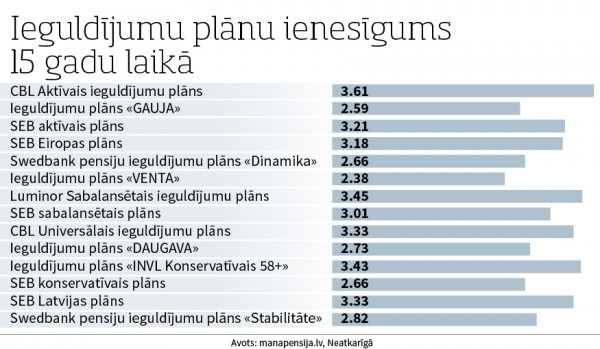

2nd pillar plans have increased their investors' pensions very modestly over the past 15 years, only by 2.66% - 3.61%. In 15 years, from 2005 to 2020, consumer prices have risen by about 62 percent. In March last year, the yield was even more modest - from 2.11% to 3.37%.

Preference for sustainable investment

Oskars Briedis, Funds Manager at Swedbank Investment Management, admitted to Neatkarīgā that the news of the rapid spread of Covid-19 last spring had a very negative impact on global financial markets. "The response of the financial market was similar to what we had already experienced during the global financial crisis in 2008. In response to such developments, the world's leading central banks - the United States, the European Central Bank in the euro area, Japan, etc. - acted very rapidly and decisively in comparison with the global financial crisis. Unprecedented monetary stimulus measures have been launched, with large-scale buy-outs of government and corporate debt securities, even investment fund certificates. This allowed asset prices in financial markets to recover rapidly. The news of vaccines last November also helped. From this, we can conclude that financial market participants are positive about the measures introduced and are hopeful about the future, although macroeconomic data are still weak. We anticipated that sooner or later there would be a recovery in stock prices, so we maintained a strategically determined proportion of shares in long-term accrual pension plans (such as life-cycle plans). We also prefer sustainable investors or issuers who take into account environmental, social and good governance factors in their operations. It is sustainable investments that have shown better results in 2020 and have recovered faster than traditional ones,” O. Briedis concluded.

The impact of the pandemic has turned out to be smaller than expected

Kārlis Purgailis, Chairman of the Board of CBL Asset Management, a subsidiary of Citadele, also admitted to Neatkarīgā that in March last year there was a sharp decline in financial markets in all asset classes due to closed borders because of the pandemic and various restrictions in several countries, which, in turn, caused investors to worry about future economic developments. "The decline took place in a few weeks and was faster than in 2008. In turn, the recovery was faster too, as globally important central banks and governments announced without delay large-scale monetary stimulus and economic support measures, thus instilling confidence in investors, and a relatively rapid recovery began. In the second half of the year, stock markets and other asset classes had already recovered and continued to grow until the end of the year. The impact of the pandemic on the economy was not as big as investors had originally expected. All markets recovered from the fall in March, and the value of both second-pillar and third-pillar pension savings was positive at the end of the year compared with the beginning of the year. Now too, a large drop or fluctuation in the markets cannot be observed,” said K. Purgailis.

According to him, the events of March clearly showed the difference between passive and active management approach. Following developments, some active managers, including CBL Asset Management, began cutting riskier exposures as early as mid-February, predicting market turmoil.

"By making the right forecast and acting accordingly, our pension plans suffered smaller losses in March, and as the recovery period began, we began to increase the proportion of riskier assets, with higher growth after March. As a result, our CBL pension plans are among the leaders in return on an annual basis. Passive management, which invests in indices, on the other hand, does not intend to change its investment strategy in the light of what is happening in the market. Therefore, these plans received a full force of the blow in March and then recovered together with the market,” explained K. Purgailis.

Pension returns need to be evaluated in the long run

Atis Krūmiņš, Head of Investment Management Baltics at Luminor Asset Management, confirms to Neatkarīgā that financial markets are affected by economic developments, but at the same time admits that this link is not as close as it might seem. 2020 was one of the worst in the world economy since World War II, but stock markets closed the year on a positive note.

"Financial markets are largely forward-looking, and if, for example, a vaccine becomes available or significant economic stimulus measures are implemented in many parts of the world, then the market takes this factor into account and adjusts stock prices accordingly. The biggest impact on the results of Latvian pension funds is by what is happening in the global stock and bond markets. Looking at the results from January 2021 onwards, the results at the end of 2020 show a partial picture of what happened last year. The year was one of the most unusual in a long time for financial markets, as in many other areas. In March, when the financial markets reached their lowest point in recent years, active class plans, which invest up to 50% in shares, had fallen by an average of 11-17% since the beginning of the year. Subsequent statements and steps by governments and central banks to stabilize the economic situation significantly improved the situation in the financial markets. By the end of the year, most pension plans had already recovered their loss and closed the year in positive territory,” explains A. Krūmiņš.

According to him, the past year has proved that pension savings and their profitability must be evaluated in a long-term perspective. "Shocks and fluctuations are part of the daily life of the financial market, so it is important to keep a perspective and not try to make decisions based on short-term results. However, it is important to choose an investment strategy appropriate to your age - as you approach retirement age, reduce the risk of savings by choosing plans with a more conservative investment strategy. This will help to reduce the fluctuations in the value of pension savings as you approach retirement,” suggests A. Krūmiņš.