The secret of the Kariņš government's existence is revealed

The Minister of Finance and the Director General of the State Revenue Service, in their answers to Neatkarīgā’s questions on tax evasion in the bus passenger transport sector, confirm everything said in Neatkarīgā’s publications of July 11 and 12 "Bus oligarchs do not transport passengers" and "Tax evaders found for state contracts".

July this year started with another scandal concerning the redistribution of bus passenger transport. In a rush to finish it before the 14th Saeima elections, the Road Transport Administration (RTA), commanded by the Ministry of Transport, took away the transport rights on the Ogre and Aizkraukle routes from company CATA and gave them to Liepāja Bus Park (LBP), even though at that time it was not able to carry out the amount of transport agreed by the state and therefore also subsidized. It was not a question of individual services disrupted by a car accident or other equally unpredictable circumstances, but of dozens of services every day. The LBP then managed to normalize the situation. At present, there are no reports that the Ogre and Aizkraukle routes, as well as the routes operated by LBP as a whole, are more endangered than all other regular bus services in Latvia.

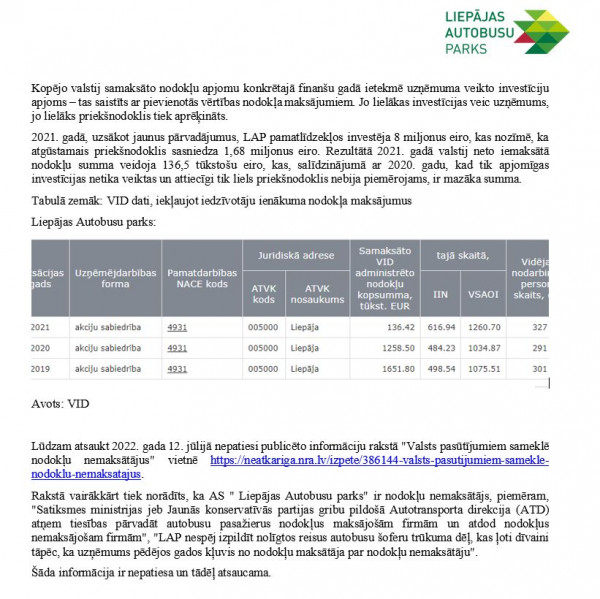

The failure of LBP to take over bus passenger services confirmed that some thorns will become visible despite people’s best attempts to hide them. To hide this particular thorn, LBP had at its disposal about one million euros in unpaid taxes - enough money to lure drivers away from the tax-paying carriers. LBP's net tax payments have fallen in recent years from 1.65 million in 2019 to 1.26 million in 2020 and further to 136 thousand in 2021. However, the LBP did not know how to manage these millions of unpaid euros to the state in a way that did not draw undue attention to a number of highly compromising circumstances. Firstly, to itself as a tax evader. Secondly, to its owners, among whom Ainārs Šlesers, who has allegedly not yet given up his political ambitions, has had LBP buses converted into his advertising objects (pictured).

Thirdly, to the New Conservative Party (Jaunā konservatīvā partija), whose delegate, Transport Minister Tālis Linkaits, bears the main responsibility for all the shenanigans and nonsense that has taken place in the bus passenger transport sector in recent years.

LBP tried to cover up its inability to fully justify the privilege of tax evasion with a letter to Neatkarīgā from Leonīds Krongorns, the company's chairman:

- The total amount of taxes paid to the state in a given financial year is influenced by the amount of investments made by the company - this is linked to value added tax payments. The more investment a company makes, the more input tax is calculated. In 2021, LBP invested €8 million in fixed assets when starting up new transport operations, which means that input tax recoverable amounted to €1.68 million. As a result, the net amount of tax paid to the state in 2021 was €136.5 thousand, which is lower than in 2020, because then such a large investment was not made and therefore such a high input tax was not applicable. Please retract the false information published on July 12, 2022, in the article "Tax evaders found for state contracts" on https://neatkariga.nra.lv/izpete/386144-valsts-pasutijumiem-samekle-nodoklu-nemaksatajus. The article repeatedly states that JSC Liepājas Autobusu Parks is a tax evader, e.g. "The Road Transport Directorate (RTA), which is doing the will of the Ministry of Transport or the New Conservative Party, takes away the right to transport bus passengers from tax-paying companies and gives it to a tax evader", "LBP is unable to fulfil its contracted services due to a lack of bus drivers, which is very strange because the company has turned from a tax payer to a tax evader in recent years". This information is false and should therefore be retracted.

However, the information is true and should be published again, as confirmed by further correspondence with the LBP. The allegation that LBP was unable to operate all the agreed flights was true on the date of its publication. Performance has now returned to normal, which is not in dispute. LBP failed to answer the question on what basis LBP should recover the input tax from the state: "The company has already clarified the questions you asked regarding the tax payments. Thank you for your additional questions, but you can find the answers to these questions in the answers sent earlier," told the blatant lies sent on behalf of the LBP by the PR firm it hired. Anyone interested can read and re-read the first reply of the LBP, which does not give any basis for the VAT recovery. According to Latvian law, such a ground is the export of goods or services. This is very clearly demonstrated by the state-owned company LDz Cargo as the largest recipient of VAT refunds in 2021, amounting to tens of millions of euros, which is clear: the company did indeed provide services to foreign cargo owners. But what services has LBP exported, transporting passengers between Liepāja and Latvia?

The State Revenue Service (SRS) responded to Neatkarīgā’s publications on VAT fraud schemes first indirectly with a statement "VAT gap or unpaid VAT continues to decrease", released on July 13, which was a direct statement by SRS Director General Ieva Jaunzeme that "the risks of VAT fraud have now been reduced to a minimum". I thank her first for admitting that VAT fraud does indeed continue in Latvia, and then for the opportunity to ask, very precisely, whether it is the "minimum of VAT fraud" that has turned LBP and Nordeka from taxpayers into non-taxpayers, while Latvijas sabiedriskais autobuss has always been a non-taxpayer. The SRS's reply that "commenting on a single phrase, or more precisely a single sentence, which, among other things, can be read in this press release, will not give an idea or clarification" brings to mind another popular observation about the inability to walk two steps without tripping over one's own two feet.

Further, the Minister of Finance, Jānis Reirs, also reacted to Neatkarīgā’s publication of July 12, which stated:

- New Unity (Jaunā Vienotība) is, after all, the party of the Prime Minister and the Finance Minister, which is directly responsible for the SRS. And without the support of the SRS and its Director General Ieva Jaunzeme, the RTA would not be able to distribute state subsidies to companies that do not pay taxes to the state. Yes, the relationship between Finance Minister Jānis Reirs and Jaunzeme is now being sorted out through the courts, but the data on taxpayers and non-taxpayers in the passenger transport sector, collected here, is reason to ask Jaunzeme more serious questions than has been done so far.

Reirs' written reply to Neatkarīgā did indeed include a question, but not to the SRS. Here is Reirs' answer in full and in all its glory: "Did the RTA ask for information on tax evaders, tax payments? The ministry of each sector regulates its own sector, and the Ministry of Transport makes the rules for that sector." Thus, at least in the final stages of the Krišjānis Kariņš government, the secret of its existence has been revealed: that the ruling coalition parties, in the sectors assigned to them, i.e. the ministries, "regulates its own sector", which include the right to exempt companies chosen by the parties from paying taxes.