This year some get higher wages, some - higher taxes

Almost all public officials will have a salary increase this year. Minimum wage recipients will also receive higher wages. Also, as a result of tax changes, workers should receive a larger take-home pay than last year, even if the salary itself is not increased. However, at the same time, due to higher taxes, tobacco products, alcohol, waste, and vehicle maintenance will become more expensive this year. Consequently, it is possible that increases in one tax will "eat up" the benefits from a reduction in other taxes.

A bit larger take-home pay

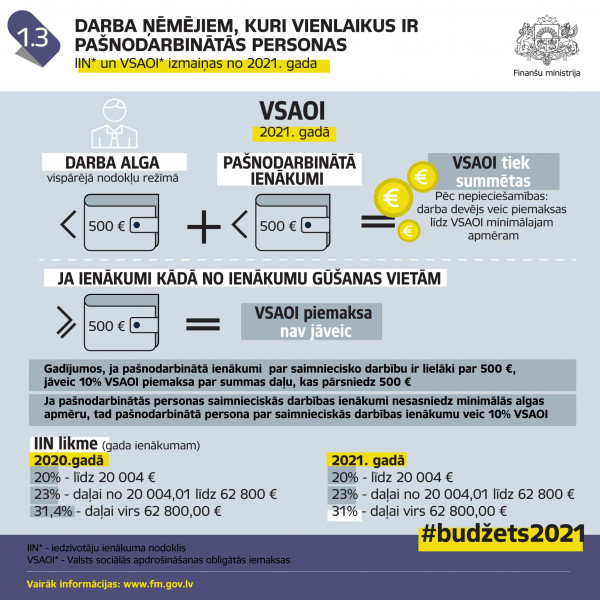

This year, the minimum wage is 500 euros instead of the previous 430 euros, the employee's mandatory state social insurance contribution rate is 0.5 percentage points lower, the differentiated non-taxable minimum will be applied to income up to 1800 euros, compared to the previous 1200 euros. This means that those working regular jobs will receive a little more to take home than last year, even if the salary remains at the previous level. In turn, recipients of the minimum wage and almost all officials (except for the President of the State, deputies of the Saeima, and some deputies of local governments) will receive higher remuneration than last year.

According to Neatkarīgā's calculations, those whose salary does not change will receive a little more than last year, for example, take-home pay for salaried employees receiving 100 euros (without dependents) will increase by 23 euros per month, for ordinary Saeima deputies - by about 12 euros per month.

If a salary increase is expected, then the benefit will be greater. For example, recipients of the minimum wage without dependents will receive about 58 euros more than last year, ministers - about 107 euros more after taxes than last year.

More expensive alcohol and waste

From January 1, all tobacco substitutes and components for the preparation of liquids used in electronic cigarettes have become excise goods and therefore subject to excise duty. Also, from January 1, there are increased rates for tobacco products, but the rate of excise duty on cigarettes will increase on March 1, 2021.

From March 1, the excise tax rate will increase for alcohol: excise duty on beer will be no less than 15.20 euros per 100 liters (now - 14.40 euros); for wine from 106 to 111 euros per 100 liters; for other alcohol - from 1642 to 1724 per 100 liters of absolute alcohol (100% alcohol).

Natural resource tax rates have been increased for municipal waste and hazardous waste disposal, air pollution, fixed tax payment for category C polluting activities. As a result, the fee for unsorted municipal waste management will increase.

The decline of the alternative tax system

From January 1, 2021, the Micro-Enterprise Tax (MET) system has been significantly changed, stipulating that a 25% MET rate will be applied to the turnover of up to 25,000 euros and a 40% rate to turnover exceeding 25,000 euros. MET revenues will be distributed as follows: state social insurance mandatory contributions (SSIMC) - 80%, personal income tax (PIT) - 20%. The MET system is no longer intended for VAT payers, it will not be possible to apply it to the form of economic activity of SIA and use it for the employment of workers. The MET system will be applicable to only one person for their economic activity, thus the person will be socially insured as a self-employed person.

Experts of the law firm Sorainen have concluded that with these and other tax changes, everything possible has been done to make it no longer profitable for entrepreneurs in Latvia to work as a payer of a micro-enterprise tax (MET). In turn, from 2023, the status of economic operators will become unfavorable. The patent fee system is also being basically abolished, as it will henceforth only be available to pensioners and people with disabilities. Consequently, most entrepreneurs will have only one choice - to register an SIA and switch to the general tax system.

The recipients of royalties will be impacted by changes starting from July 1, 2021. If the royalty is paid by the payer of income, which is a collective management organization (for example, AKKA/LAA), then the payer of income will withhold 20% of PIT during the taxation year, applying the notional expenditure rate - 25% of income. If the total income during the taxation year exceeds 20,004 euros, the progressive PIT rate will be applied (for income from 20,004 euros to 62,800 euros - 23%; for the part of income exceeding 62,800 euros - 31%), which is calculated in summary form by submitting annual income statement.

On the other hand, if the royalty is paid by another payer of income, which is not a collective management organization, and this natural person has not registered as an economic operator, from 1 July 2021 to 31 December 2021, it will be subject to a special PIT transitional mode - from the income of up to 25,000 euros payer withholds tax in the amount of 25%, from income exceeding 25,000 euros, applying a rate of 40%. In this case, the royalty payer will not apply the notional expenditure rate. Withheld PIT revenues will be distributed as follows: SSIMC - 80% and PIT - 20%. If the natural person receiving the royalties registers the economic activity, he will be able to choose whether to pay PIT in the general system or register as a payer of MET.