The average pension in Latvia is twice as small than that in the European Union

The average pension in the European Union countries is over a thousand euros, which is 70 percent of the average net salary in the European Union, while in Latvia the average old-age pension is more than twice as small. Only Romania and Bulgaria have lower pensions than Latvia.

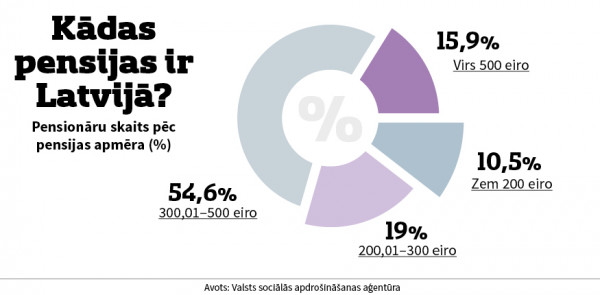

Data from the State Social Insurance Agency show that more than half of pensioners receive pensions in the range of 300 to 500 euros, but at least a tenth have to survive on a pension of only 200 euros or even less per month.

When retiring - get 60 percent less

In Latvia, the average old-age pension is 365 euros per month or 44 percent of the average net salary in the country. "Now each of us can ask ourselves how I would feel if my monthly income dropped by 60 percent from tomorrow," said Anželika Dobrovoļska, head of pension products at Luminor Bank, in a discussion about the future of the pension system. In the European Union, the average old-age pension is 1,100 euros per month, which is 70 percent of the average net salary in the European Union. "Of course, there are richer countries, where the average pensions of the population even exceed two thousand euros, there are countries that are less wealthy, but we, Latvia, are unfortunately in the lowest pension group," says A. Dobrovoļska. "The size of pensions depends on several factors - the pension system, the economic situation, the total level of wages, but there is another important thing - how many people create savings themselves. Eurostat data show that the average income of people over the age of 65 is about 1,400 euros per month, this amount also includes people's savings and property, but in Latvia this average income is about 450 euros." The situation is worse only in Bulgaria and Romania. The total savings rate in Latvia is only six percent of the total household income, while in the European Union it is on average 12 percent, but in Estonia it is even higher than the average and makes up 13 to 14 percent.

The specialist points out that all over the world, the state-provided pension is only a part of what a person receives in old age, but a large part is made up of savings. Speaking of Latvia, it must be concluded that people accumulate very little, for example, only about a third of employees are members of the third pension tier. The positive news is that the number of these people is growing. "If we want to receive a pension like in Europe, then we have to take care of the savings ourselves," said A. Dobrovoļska.

Saving for old age - not a priority

Associate Professor Baiba Bela, Faculty of Social Sciences, University of Latvia, referring to the research data, said that in Latvia only 13 percent of the population regularly make savings, but there are also some people who make savings irregularly. "One could say that the reason could be low income, as the lowest share of people who save is among the population with an income of less than 400 euros per month, but even among the population with an income of more than 800 euros per month, which should be able to afford making savings, only 17.8 percent do so,” said Baiba Bela. "One third of the population, if they lost their job, could live on their own resources for a week, a quarter could manage for a month, and only a small number could live on their savings for more than three months."

The researcher points out that people have different priorities and urgent needs, and the first thing that people think about and why they can't save for the future is utility bills and daily bills. This is priority for 84 percent of the population. At the same time, a very large number of respondents have admitted that the main thing is to live here and now, not to save for the future. In addition, savings for the future appear only as a sixth or seventh priority. "People need to think a lot about how they will live and how they would like to retire, especially people who want to keep the same active and secure life as before retirement," Bela said.

Diāna Kurpniece, Senior Consultant at PricewaterhouseCoopers' Business and Deals Consulting Department, urged to be honest and to say that the small number of savers is due to the high proportion of people who receive extremely low salaries. Researcher Baiba Bela agreed, noting that a third of employees receive the minimum wage or below the minimum wage. In addition, the situation in Latvia is very different, depending on where people live. "You can have a good higher education, but it will make a difference whether you live in Riga or Zilupe," said B. Bela.

Pension system - what the future holds

"Currently, one pensioner is supported by three workers, but in 30-40 years there will be only two workers, so decisions at the state level in the field of pensions will definitely be expected - the state may have to decide whether to increase the retirement age or increase taxes for employees or reduce pensions,” admitted the bank's expert. She emphasized that currently we need to think about how to encourage people to consider long-term decisions. A. Dobrovoļska referred to Estonia, where the pension reform has just taken place: any citizen can withdraw from the second tier of pensions, spend this money now or transfer it to another investment system. "On the one hand, this is the modern reality, freedom - we can choose how to manage our savings, but on the other hand, it automatically imposes a much greater responsibility on me as a person, how I handle this money, and on this will depend my future,” says Anželika Dobrovoļska, emphasizing that saving is also related to human discipline and habits. From the bank's data, it can now be concluded that one third of third-tier pension savers are in the age group of 40 to 50 years. The second largest age group is between 50 and 60 years, and only then is the age group between 30 and 40 years old. People under 30 years of age make the least savings in the third tier of pensions.