Latvijas dzelzceļš still has cargo from Russia

Russian propagandists describe the company Latvijas dzelzceļš (LDz) as dead, but Russian railwaymen - visit it like someone on their deathbed.

Last winter, Russian propaganda publications did not miss the scrap metal auctions organized by LDz as a reason to claim that this economic activity that would be innocent in other circumstances proved the sale of the rails before the liquidation of the company. According to the Russian news agency RIA Novosti, this is an inevitable consequence of the decision of the Russian authorities not to allow (in Russian bureaucratic terminology "not to agree upon") freight wagons (platforms, tanks) to travel through Latvia, through which Russian entrepreneurs still wanted to send their cargo. “In November, 100% of the requested amount was not agreed upon,” Neatkarīgā quoted the rejoicing of RIA Novosti on February 3; that publication provides a link to the source of the citation.

More precisely, in November, Russia completely stopped sending only coal cargoes through Latvia, but this was presented as an example that it can do so and that the same will be done immediately with all other cargoes.

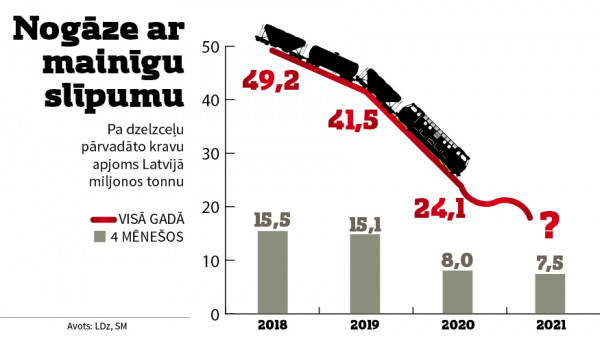

However, this was not done before 2021, or in January this year, or until now. In the four months of this year, the volume of cargo transported by LDz was 6.9 million tons. This corresponds to a decrease in freight volumes of 12.9% compared to the first four months of 2020. Such a decrease would otherwise require to sound all alarms, but can now be called almost volume stability if the current reduction is rounded to 1/10th and compared to a reduction in 2020 of almost half compared to 2019.

The Ministry of Transport showed a larger volume of rail freight transported across Latvia in the amount of 7.5 million tons, as rail freight transport along railways owned by the Latvian state and maintained by LDz is also performed by several private companies. Such an overview is, on the one hand, more optimistic, because then there is more cargo and the decrease is only 6%, but, on the other hand, questions arise as to why a state-owned company is losing in the competition for cargo, which can still travel through Latvia.

In order to refute the allegations about the complete disappearance of cargo of Russian origin and LDz's passivity in attracting cargo, on May 21 the company distributed a text and photo about the arrival of the First Deputy Director of the Russian October Railway Sergei Dorofeyevsky in Riga for talks with LDz Board Chairman Māris Kleinbergs. It would be too much to ask that the head (начальник) of the October Railway Viktor Golomolzin come to Latvia for economic rather than political reasons. After all, the company he manages is many times larger than LDz. The company's website shows the performance indicators of 2019, which also shows 294.8 million tons of transported cargo. This is seven times more than 41.5 million tons that were transported by rail in Latvia that year. In addition, a significant part of the October Railway work is suburban and long-distance passenger transport, which is separated and given to other companies in Latvia.

Last year, the October Railway website was integrated into the Russian Railway website, which emphasizes the status of the October Railway as a branch and does not distinguish the volumes of traffic performed by this branch among the total indicators of the Russian Railways. Consequently, there is no chance to compare whether the October Railway in 2020 has not faced problems that are at least remotely similar to the problems of LDz in connection with the decrease of cargo volume from 41.5 to 24.1 million tons in one year.

The report prepared by LDz on the discussions between M. Kleinbergs and S. Dorofeyevsky begins with an introduction of M. Kleinbergs about the satisfaction “that in this rather challenging time, when the volumes of freight transport by rail infrastructure tend to decrease, we can meet to discuss both development and cooperation, and also what are the next steps that should be taken to increase the competitiveness of rail transport compared to other modes of transport."

With regard to luring the cargo from road to rail, LDz explained to Neatkarīgā that "this could be a comprehensive solution that would include both the running of trains according to a separate schedule, which would ensure competitive delivery time, and, of course, tariff conditions."

Another topic of conversation on innovations in railway traffic was the establishment of the Kaliningrad-St. Petersburg route via Kaunas in Lithuania and Riga in Latvia. The route was intended to expand international passenger traffic.

It could not in any way be demanded of the discussion participants to have any idea of the hijacking of the Ryanair airplane on May 23. The European Union's response was to block Belarusian airspace in every way possible, in accordance with the layout of countries, airports and air routes. At present, it is not possible to predict whether the blockade will not be transferred to the ground at least in part and will not be extended at the EU-Russia border. Previously, goods of Russian origin have been imported into Latvia via Belarus, bypassing the restrictions imposed by Russia on the flow of cargo to Latvia. Now, at least in theory, it is possible that Russia will need a route through Latvia if the delivery of its cargo to Europe across the Belarusian-Polish border is restricted. Exports of Belarusian goods to the west are even more threatened. Belarus may have to send its goods to the EU across the Russian-Latvian border, which Latvia would have to close for such cargo.

LDz can afford the fall in cargo volumes due to both economic fluctuations and foreign policy conflicts. The company is confident that this year and in the coming years it will receive state “funding to ensure the financial balance of the public railway infrastructure operator” following the model started in 2020.

LDz justifies asking for money with the promise that the money will be needed only “until 2025, until LDz will be able to ensure the maintenance of the railway infrastructure with its own financing by gradually developing operations in diversified markets and introducing a new business model.” "Diversified markets" sound like polite hopes for Russia's division without guarantees when and if that could happen at all. Equally vague are the hopes for a "business model" that could not be devised in the 30 years since the restoration of the independence of the Republic of Latvia, or over the less than three years of the current government, the current Minister of Transport and, albeit for a shorter time, M. Kleinbergs' current position, but which will certainly be in place by 2025.

*****

Be the first to read interesting news from Latvia and the world by joining our Telegram and Signal channels.