The Financial Intelligence Unit boasts of undermining Latvia's international prestige!

On March 5 of this year, the Financial Intelligence Unit published their self-made summary “National Money Laundering, Terrorism and Proliferation Financing Risk Assessment Report for 2017-2019". In this report, the FIU itself assessed its (Latvia's) ability to manage money laundering risks and the sustainability of the established anti-money laundering prevention and control system as high.

Really! If public bodies are allowed to evaluate their own activities, then they cannot be particularly critical of the evaluation of their activities, because any criticism will mean a high risk the management of the institution will change! This is especially true in cases when the activities of the institution are destructive to the interests of Latvian society.

As the document published on March 5 is the first report of its kind under the auspices of the Financial Intelligence Unit, it is worth analyzing in detail. Assessing the conclusions included in the report, the head of the Financial Intelligence Unit Ilze Znotiņa says: “Our conclusions are positive: we have become smarter, we have learned how to identify risks in a timely manner, and we are learning to manage them accordingly. Our system is robust, our policy instruments and range of actions are flexible enough to withstand existing and potential MLTPF risks. But at the same time, we must not be complacent. Threats and risks are becoming more complex. The criminal world is finding ways to adapt and is trying to find new ways to circumvent our obstacles. The Covid-19 pandemic has also opened up new opportunities for criminals who want to exploit national vulnerabilities in the state of emergency, as well as increased operating in the digital environment, so work needs to continue."

What are the main achievements of the Financial Intelligence Unit? This is clearly stated in section 2.2.2 of the report summary.

"At the beginning of 2019, the Latvian government abandoned the previous goal of positioning Latvia as a regional financial transaction center.

The previous approach attracted significant transit flows of funds, as well as deposits from the CIS countries and other high-risk countries and jurisdictions. However, taking into account the government policy implemented during the reporting period and the revocation of licenses by LAS ABLV Bank and MAS PNB Banka, the financial sector in Latvia has been transformed (including de-risking), which asked credit institutions to abandon disproportionately high-risk customers, such as servicing certain shell corporations” (National MLTPF Risk Assessment Report 2017-2019 (summary), pp. 8).

This means that the management of the Financial Intelligence Unit set as its task the change of the political direction of the government, not the fulfillment of the functions and tasks assigned to it by law!

The goal of FIU management is to reduce Latvia's place in international ratings

Therefore, it is not surprising that the report states with great satisfaction (section 2.2.3): “Latvia's cross-border financial flows have significantly decreased, and in 2019 the total amount of cross-border payments slightly exceeds EUR 110 billion. The volume of cross-border payments received and sent in foreign currencies has decreased significantly. Accordingly, the potential threat of money laundering arising from cross-border payments is reduced. The gradual decline in the role of the financial center is also indicated by a significant decline in Latvia's rating in the Global Financial Centers Index, when Latvia was ranked 53rd in the September 2017 report and 85th in September 2019 among the global financial centers” (National MLTPF Risk Assessment Report for the period 2017-2019 (summary), pp. 8).

However, reading FIU report section 2.2.11. which states that “In general, it must be concluded that foreign predictive crimes in countries with a high risk of corruption and cross-border flows of funds from these countries to Latvia during the reporting period posed a greater money laundering threat than national predictive crimes” (National MLTPF Risk Assessment Report 2017-2019 (summary), pp. 9), there are serious doubts as to the accuracy of the FIU report when compared with the actual data and observations.

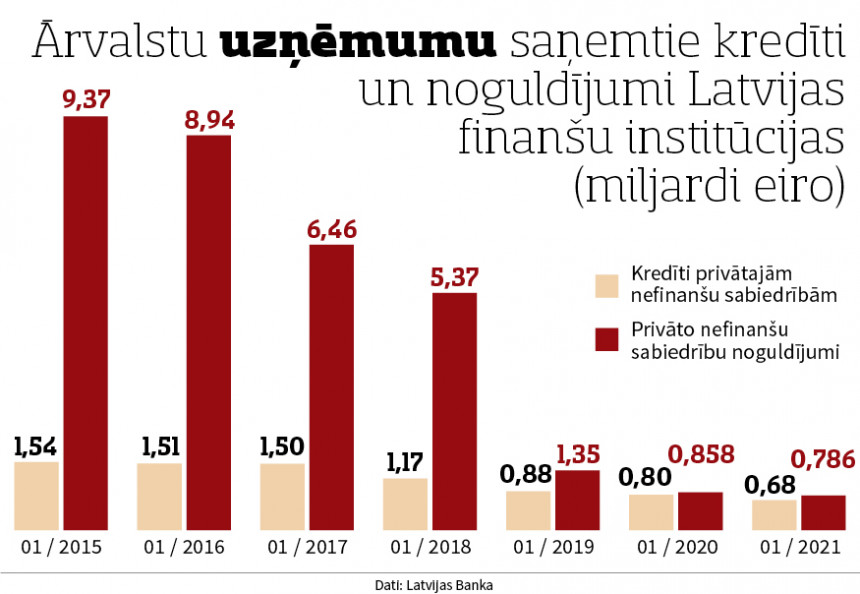

According to the Bank of Latvia's statistics on the activities of banks and other financial institutions in Latvia, in January 2015, foreign companies (other than financial institutions) deposited money in Latvian financial institutions in the amount of EUR 9.37 billion (Figure 1). After the FIU started operating in Latvia (2018) against servicing foreign companies, indirectly accusing every foreign company of illegal actions, foreign companies began to suspend cooperation with Latvian commercial banks. In January 2019, foreign companies (which are not financial institutions) deposited money in Latvian financial institutions in the amount of only 1.35 billion euros, in January 2020 only 0.86 billion euros, while in January 2021 - 0.79 billion euros. In January 2020 and 2021, compared to 2015, the amount of deposits of foreign companies (which are not financial institutions) in the Latvian financial system decreased by more than 10!!! times. In addition, of all corporate investments in 2021, about 40% of the funds belonged to companies established in the euro area. The amount of deposits of non-euro area companies in Latvia has decreased more than 15 times during the last five years.

Therefore, statements of potential very high criminal risk of cross-border money flows should be seen either as evidence of the complete incompetence of FIU management or as a deliberate misleading of the government, legislators and the public.

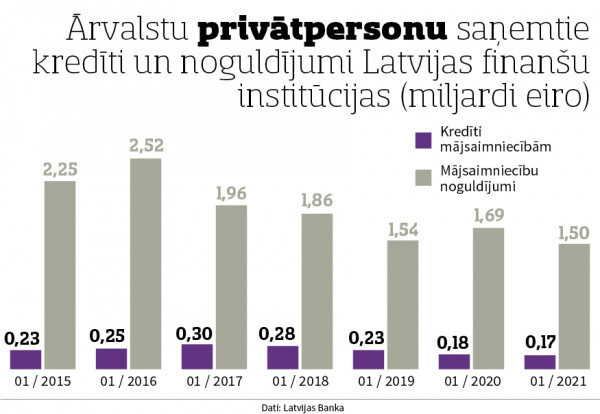

Deposits of foreign individuals (households) in Latvian commercial banks are still quite large. In 2020, deposits of foreigners - individuals in Latvian financial institutions (according to the statistics compiled by the Bank of Latvia) were 1.7 billion euros, but in January 2021 - EUR 1.5 billion (Figure 2). Two thirds of these deposits were from euro area nationals. As you know, tens of thousands of EU citizens live in Latvia, and one of the basic principles of the EU is the free movement of goods and capital. Therefore, Latvia has no legal basis to prohibit the citizens of the EU and especially the euro area countries from using the services of Latvian commercial banks.

If we objectively assess the amount of work that would be required for FIU after the expulsion of practically all foreign companies from the Latvian financial system, then it would be normal to downsize FIU ten times. From 2019, the FIU is working with 10 and 15 times less deposits than in 2015 or 2016. However, this is not in the interests of FIU management. If a public body monitors itself and gives assessments of its own activities, then it wants to receive additional resources, even as the workload decreases. It demands them, and anyone who opposes it is declared an accomplice to the money launderers! The FIU report unequivocally highlights the main benefits of the last two years: an additional 135 new posts were created in 2019 and a further 72 posts in 2020 (National MLTPF Risk Assessment Report 2017-2019 (summary). pp. 24).

It must be concluded from this that FIU is publicly and internationally boasting of undermining Latvia's international prestige! The FIU has become an employment office for leeches, so as long as Krišjānis Kariņš supervises the leech-employing office, nothing will change. It is time to launch a parliamentary inquiry and oversight of the FIU.

*****

Be the first to read interesting news from Latvia and the world by joining our Telegram and Signal channels.